By: Ella Shaby, Northbrook Financial Intern, Spring 2024

Opening your first credit card is a significant milestone in your financial journey. It provides a convenient means of payment for day-to-day expenses and a necessary tool for building your credit history. However, the world of credit can be complex and overwhelming, especially for beginners. In this article, we’ll cover fundamental credit insights, tips for building credit, and important considerations to bear in mind before opening your first credit card.

Most Important Rule About Consumer Debt:

Before taking on any credit responsibility, it is essential to remember that consumer debt (typically tied to credit cards, personal loans, etc.) has the highest relative loan interest rates. Annual Percentage Rates (APR) often range from 15-30%, generally inversely correlated with credit score. Paying off these loans on time and in full is essential to avoid these exorbitant interest rates.

What is Credit, How is it Built, And How is it Measured?

Credit is a financial tool that allows individuals to borrow money or access goods and services with the promise of repayment in the future. Building credit involves establishing a history of responsible borrowing and repayment behavior. This can be achieved through using credit cards, taking out loans, and paying bills on time. Consistent and timely payments contribute positively to one’s credit score, a numerical representation of creditworthiness. Credit scores are measured by various credit bureaus using algorithms that consider factors such as payment history (35%), the amount owed (30%), length of credit history (15%), new credit (10%), and credit mix (10%) (Langager). A higher credit score indicates lower credit risk and increases the likelihood of being approved for loans or obtaining favorable interest rates. Therefore, cultivating good credit habits is essential for financial stability and access to future opportunities.

Let’s Define These Terms:

Payment History

- Payment history considers whether you have consistently and promptly paid your credit accounts and previous bankruptcies, collections, and delinquencies (Langager).

Amount Owed

- The amount owed considers the amount you currently owe relative to the amount of credit you have available for that period. This ratio is called Credit Utilization. This part of your credit score looks at how much debt you currently have but also considers the number and types of accounts you have open. If you have a high total debt from multiple sources, it can lower your score. It’s also a good idea to keep your credit utilization between 10% and 30% (Langager).

Length of Credit History

- The longer your credit accounts are open and in good standing, the more favorable they are. For example, lenders will perceive someone who has consistently made timely payments over 20 years as less risky than someone who has only been on time for two years (Langager).

New Credit

- Frequent credit applications may suggest financial stress, resulting in a slight decrease in your credit score with each application. It’s recommended to weigh the value of obtaining additional credit against the impact on your credit score before opening a new account (Langager).

Credit Mix

- Lenders prefer to see a diverse credit mix, indicating your ability to handle various types of credit effectively. Ideally, your credit portfolio should include both revolving credit (such as credit cards, retail store cards, gas station cards, and lines of credit) and installment credit (like mortgages, auto loans, and student loans) (Langager).

Your Credit Score:

We’ve discussed how to build your credit score and the different components that are accounted for when your credit score is calculated, so now, let’s talk numbers.

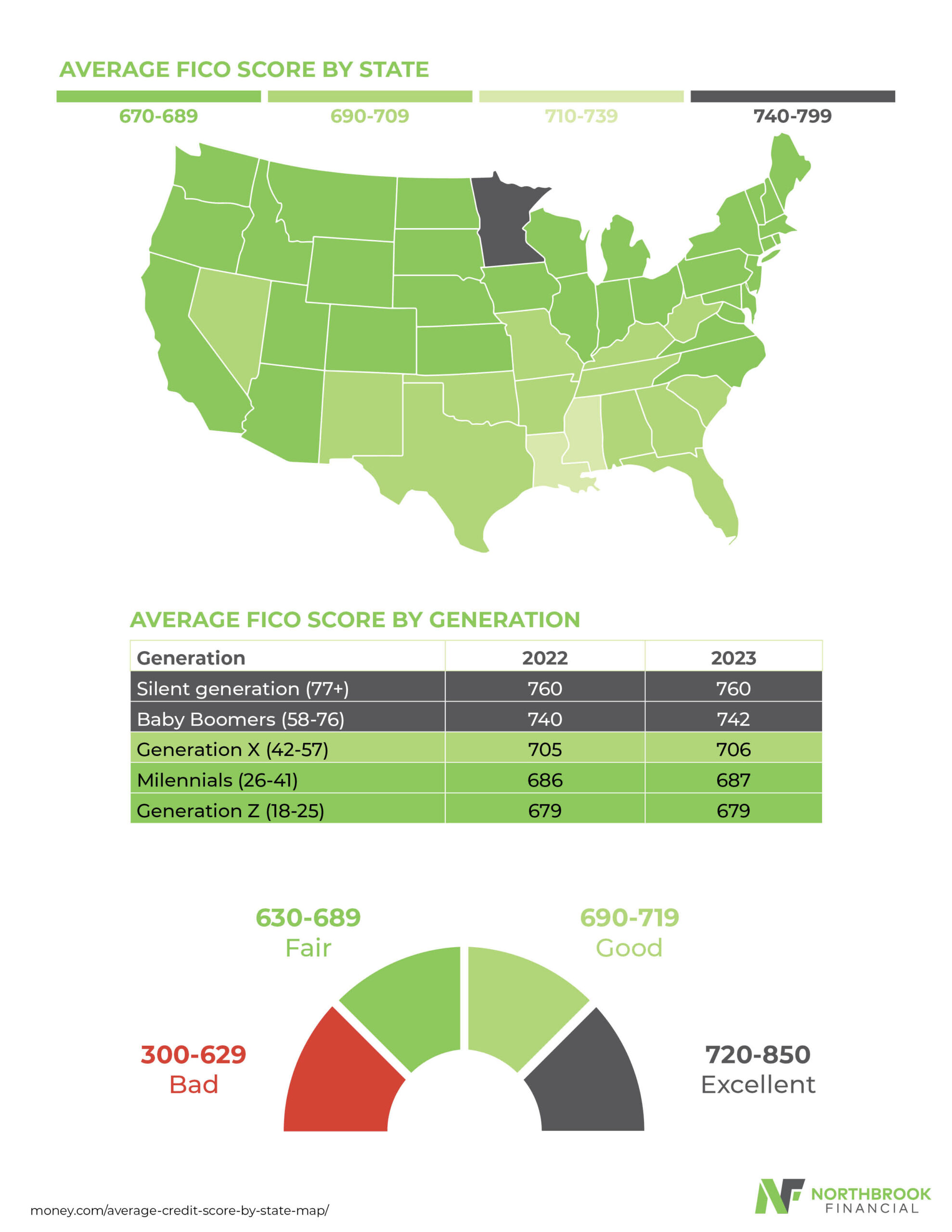

Your credit score ranges between 300-850, with the national average of 714 as of 2022, falling in the higher end of the “good” range (Hardy). You can calculate your approximate credit score for free on websites such as Credit Karma, Credit Sesame, and NerdWallet. However, it is important to note that lenders may use slightly different numbers.

Average credit scores vary by state and age. Refer to the following charts to see where you compare to your state’s and generational average (Hardy).

What Should You Keep in Mind When Opening Your First Credit Card?

Interest Rates and Fees: Pay attention to the card’s annual percentage rate (APR), and be aware of any annual fees, late payment fees, or other charges associated with the card.

Credit Limit: Understand the credit limit assigned to your card and how it aligns with your financial needs while keeping your credit utilization ratio low to positively impact your credit score.

Rewards and Benefits: Consider whether the card offers rewards or benefits such as cash back, travel points, or other perks. Choose a card with rewards that align with your spending habits and preferences.

Payment Schedule and Due Dates: Establish a payment schedule and ensure you understand the due dates for your credit card payments. Missing payments can result in late fees and negatively impact your credit score. Setting up an automatic payment system can help avoid interest payments and a decline in your credit score.

Budgeting and Responsible Use: Create a budget to manage your spending and avoid overspending on your credit card. Responsible use of credit involves making timely payments and keeping balances manageable.

Credit Building: Recognize that your credit history with your first credit card will impact your credit score and future borrowing opportunities. Building a positive credit history early on can benefit you in the long run.

Security Measures: Familiarize yourself with the card’s security features and take precautions to protect your card information from fraud or unauthorized use.

Comparison Shopping: Take the time to compare different credit card offers to find the one that best suits your needs and financial situation. Consider factors such as interest rates, fees, rewards, and customer service reputation.

Starter Credit Cards to Consider:

It can be overwhelming to research, apply, and responsibly manage the right credit card when you are getting started. Below are three cards recommended to people just starting their credit-building journey. To get more information about each mentioned card below and view some other good options, see this Nerdwallet article.

All the following information is relevant as of April 2024.

Student Cards: Student credit cards are great for working college students, as they don’t need upfront deposits like secured cards. However, if you’re under 21, you need independent income to qualify. The Discover it® Student Chrome card is a sound card for this (Soucy).

Secured Cards: Secured credit cards are suitable for individuals without a credit history seeking a first card from a major issuer. They entail an initial refundable deposit, typically matching the card’s limit, which is returned if it is upgraded or closed in good standing. A sound card for this would be the Discover it® Secured Credit Card (Soucy).

Standard Starter-Card: These cards typically have no annual fees and require no deposit while having decent rewards depending on the issuer and specific card. The Chase Freedom Rise℠ Card is a sound card for this (Soucy).

Works Cited:

Hardy, Adam. “This Map Shows the Average Credit Score in Every State. How Do You Stack Up?” Money, 13 June 2023, money.com/average-credit-score-by-state-map/.

Langager, Chad. “How Is My Credit Score Calculated?” Investopedia, Investopedia, 31 Mar. 2023, https://tinyurl.com/mtz3efpf.

Soucy, Paul. “Best Starter Credit Cards for No Credit of April 2024.” NerdWallet, 10 Apr. 2024, www.nerdwallet.com/best/credit-cards/no-credit.

The information contained herein is intended to be used for educational purposes only and is not exhaustive. Diversification and/or any strategy that may be discussed does not guarantee against investment losses but are intended to help manage risk and return. If applicable, historical discussions and/or opinions are not predictive of future events. The content is presented in good faith and has been drawn from sources believed to be reliable. The content is not intended to be legal, tax or financial advice. Please consult a legal, tax or financial professional for information specific to your individual situation.

This content not reviewed by FINRA

Northbrook Financial is an Investment Adviser registered with the State of Maryland. All views, expressions, and opinions included in this communication are subject to change. This communication is not intended as an offer or solicitation to buy, hold or sell any financial instrument or investment advisory services. Any information provided has been obtained from sources considered reliable, but we do not guarantee the accuracy or the completeness of any description of securities, markets or developments mentioned. Please contact us at 410-941-9709 if there is any change in your financial situation, needs, goals or objectives, or if you wish to initiate or modify any restrictions on the management of the account. Our current disclosure brochure, Form ADV Part 2, is available upon request, and on our website https://www.northbrookfinancial.com