Inflation: What is it and why are we freaked out by it?

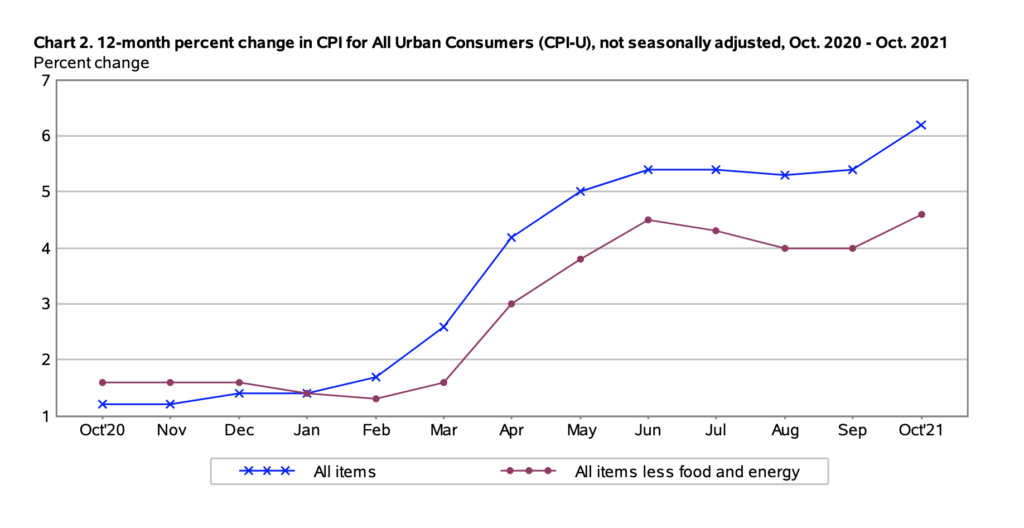

Inflation is a decline in the purchasing power of a given currency, and is measured by the rate of change in the average price level of goods and services over some period of time. In simple English – inflation means the things we buy are getting more expensive. In moderation, inflation is considered a good thing. Extremely high inflation, on the other hand, can cripple a nation’s economy. If people are worried that prices tomorrow will be higher than today, they rush to buy more stuff today (as opposed to saving). This can lead to a spiraling self-fulfilling prophecy, pushing inflation higher. Since 1990, the average annual inflation rate has been ~2%, in line with the US Central Bank’s long term target rate. In its most recently released report, however, the US Bureau of Labor Statistics reported that the Consumer Price Index (the key inflation metric) rose by 6.2% over the last 12 month (not seasonally adjusted). This is much higher than the government’s target rate, and we can relate to how inflation has impacted us. Groceries, gas, and travel all seem to be getting more expensive.

*https://www.bls.gov/news.release/pdf/cpi.pdf

High inflation in the US during the 1970’s was tremendously disruptive to the US economy (with gas lines and mortgage rates in the double digits). Israel experienced periods of hyperinflation with annualized rate increases reaching 400% in 1984. Venezuela is currently experiencing mind-boggling inflation: the government is not currently publishing inflation statistics, but the International Monetary Fund has estimated that inflation in 2021 will be 5,500%.

What can you do?

When asked about his thoughts on inflation, famed investor Warren Buffet commented, “The arithmetic makes it plain that inflation is a far more devastating tax than anything that has been enacted by our legislature.” Inflation erodes the value of currency, so what is a fiscally responsible saver to do in an inflationary environment? Holding assets that serve as an “inflation hedge”, meaning they hold their “real value” or perhaps even appreciate during periods of inflation, is a smart idea. Asset classes such as gold, real estate, and certain equities have been long touted for their inflation hedge characteristics. More recently, crypto currencies have emerged as potential hedges against inflation. I have no idea where inflation is headed in the future. I am in the financial planning business, not the fortune telling business ;). However, hedging an investment portfolio can be advantageous, and investors should do their research and set an asset allocation, including appropriate hedging strategies – assess your risk!

US Government I Bonds:

I would like to focus on a simple strategy for protecting against inflation without taking on significant downside risk. US Government I Bonds are issued directly by the US Government and pay an inflation-adjusted interest rate that currently stands at an annualized 7.12%! The interest rate is adjusted every 6 months (it was 3.54% in the previous period) and is calculated based on a formula that includes a fixed rate + the “semiannual inflation rate”. The current high yield savings account is paying ~0.50%, inflation is running north of 5%, so I Bonds provides a great place to stash some cash. There is some nuance on investing in I Bonds and Treasurydirect.gov has great information, but here is some “fine print”

Maximum Investment: $10,000 per person per year. It is possible to increase this to $15,000 – check the website.

Withdrawals: There is a 12 month lock-up period. This means you will not be able to cash out your I Bonds for the first 12 months. Withdrawals made after 12 months but before 5 years will incur a penalty equal to 3 months of interest. Even with the penalty, an I Bond cashed out before 5 years still provides a superior return.

Interest Rate Changes: The interest rate is adjusted every 6 months, and the formula to calculate the interest rate is provided on Treasurdirect.gov.

Tax Considerations: Interest earned on I Bonds can be deferred until the year you withdraw cash, and is always exempt from state taxes. If you have qualifying education expenses, the interest might be exempt from federal taxes as well.

For anyone who has excess cash or is saving for a specific goal, I Bonds can be a great place to earn some extra yield without the risk you face in the stock or bond market. The below chart analyzes hypothetical scenarios comparing the interest earned on a $10,000 cash balance kept in a high yield savings (at current rates) vs. kept in an I Bond (at current rates).

Elliot’s Take:

I know that I need to keep a liquid emergency fund to “cover the unexpected” and “seize opportunities.” I have added I Bonds to my cash savings strategy by slightly overfunding my emergency savings and then buying $5,000 worth of I Bonds every 6 months. At the very least, I will be earning more than I was in my high yield account, but I also make sure that I am comfortable with losing the liquidity for 12 months. If you have excess cash that you want to put to work, but aren’t comfortable with taking on additional market risk, an I Bond could be a great place for you. At 7.12% returns for the next 6 months, I can’t see a reason not to invest!