Classically defined, investing is “the outlay of money, usually for income or profit.” In personal finance, investing can be found at the crossroad of human knowledge and human behavior. We are inundated with information about financial investments and naturally are attracted to promises of quick, low risk, high returns. If the “gurus” are right and there is an easy path for investment success, why aren’t we all reading this from our yacht in the Greek Isles? The answer is simple – the gurus are not always right. In fact, they tend to be mostly wrong. Over the past 15 years, approximately 87% of actively managed mutual funds (i.e. “gurus” buying and selling stock and bonds) have underperformed the S&P 500 (i.e. holding a piece of the 500 biggest companies in the US Stock Market). The recipe for long-term investment success has many ingredients, and while choosing investments is part of the recipe, it’s far from the most important ingredient. Account selection and your behavior over time drive the majority of investment returns. The good news for you is that you have much more control over them than the performance of markets.

A basic understanding of investment account types can order your personal wealth in a way that enhances returns and aligns behavior to goals.

Basic Principles:

- Pay Yourself First: Treating a transfer of money to a savings or investing account as part of your monthly expenses is a great life hack. You need to treat your savings like any other monthly expenses.

- Tax Treatment: People see “tax” and their eyes glaze over. Grab a cup of coffee and keep reading! Taxes will make up the single largest personal expense in your lifetime!. Develop a basic appreciation for taxes and ways to manage them. We spend hours comparing airline and hotel prices before a big vacation, but will completely ignore basic tax planning strategies for investments that save thousands of dollars annually. For starters, think about accounts as being either taxable or tax deferred.

- Taxable Accounts: A taxable investment account is typically opened at an institution (Vanguard, Schwab, Fidelity) and linked to your checking account. You contribute cash and then invest in stocks, bonds, and possibly other “alternative assets”. Any income received from interest, dividends, or capital gains will be taxable when earned. It is generally not the first place to invest your retirement savings.

- Tax Deferred Accounts: A tax deferred account provides tax savings on either the contributions made, the income earned within the account, or distributions taken out of the account. Due to their tax benefits, these accounts tend to be better for longer-term investments, specifically retirement, education, and health care expenses.

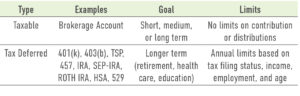

The table below gives a basic summary for the most common taxable and tax deferred accounts.

The rules governing tax deferred accounts can get complicated, but don’t let that stop you.

Applying the Principles:

- Protect Today: As the last article noted, have an emergency fund in a high yield savings account.

- Protect Tomorrow: Saving for retirement is a must. We have a responsibility to our future selves and our families to protect our future. If you are offered a workplace retirement plan (typically a 401(k), 403(b), or TSP), start contributing today. Employers may offer matching contributions based on your contribution. This is free money – take it! Aim to save at least 10% of your salary if you can. The right percent varies by person, but do something. If you do not have a workplace plan, open an IRA or a ROTH IRA and start adding. An IRA provides a current tax deduction, earnings grow tax deferred, and you pay taxes when taking distributions. ROTH IRAs provide no tax deduction on contributions, earnings grow tax-free, and distributions are tax free. It’s helpful to consult with a professional, but don’t let that stop you – any savings is better than zero savings.

- Build Wealth: Open and fund a taxable investment account. Tailor a portfolio that balances riskier but higher returning assets such as stocks against less risky but lower returning assets such as bonds. The gap between your income and expenses is your wealth – prioritize it!

I am blessed with three children and each of them has an investment account named for them that we contribute $20 to every week – it feels great! I also have my tax deferred and other taxable accounts all set up for ongoing monthly contributions. Small repetitive steps today create meaningful outcomes in the future. Morgan Housel, the author of The Psychology of Money says, “Controlling your time is the highest dividend money pays.” Oftentimes we emphasize the amount of money we want to have. Really, the emphasis is what the money can do for you. The ability to control your time is powerful, and we all seek it to varying degrees. Put time on your side: Invest early and invest often.

Personal finance is personal – and generalized advice columns like this will not apply the same way for everyone. Get informed and apply the knowledge best for your life*!

*The decision to start saving and investing is yours, the “how” can be hard. We suggest speaking with a “fee only” financial planner operating as a fiduciary – having a CPA or tax background is a huge plus. Email commoncents@northbrookfinancial.com to schedule a free financial planning consultation with our team.

_

Elliot Pepper, CPA, CFP®, MST is Co-Founder of Northbrook Financial, a Financial Planning, Tax, and Investment Management Firm. He has developed and continues to teach a popular Financial Literacy course for high school students.