Source: Bloomberg Wealth

This time, they mean it. But what does that mean for you?

Many of the world’s largest companies set September as the deadline for employees to start returning — at least more consistently — to the office. Commuter trains in New York were packed this week following the Labor Day holiday. Office rents from London to Dubai are heading upwards again. And in Australia, the return to office has set off a child-care crisis.

Firms have been trying to lure workers back for two years now. Wall Street banks have led the charge, in fits and starts. Employers like Apple have had to push back their RTO plans some half a dozen times in response to the ever-morphing pandemic.

The results have been mixed. While many staffers have been heading into work daily for months, a recent study found that in the second quarter of this year, half of office visits globally happened just once a week. Employers are trying to formalize flexibility to give managers more certainty while not alienating staff. This means hybrid policies are becoming increasingly normalized (and, as of this month, enforced) at a time of stubbornly high inflation, increased commuting costs and fear of recession on the horizon.

It’s a complicated puzzle for anyone trying to keep both their career and their finances on track. To get some insights on how to do this amid the current race to RTO, I emailed a few career and financial experts to ask for their best tips. Here’s what they told me:

Be deliberate. Managers should ask themselves what they want employees to accomplish when in the office, said Michelle Reisdorf, district president for recruiter Robert Half in Chicago. “Determine that and then communicate it effectively across your team. Whether it be meetings, trainings, brainstorming, team-building exercise or anything in-between, figure that out and have it be the driving force for others to buy in.”

Take advantage of the change. You might dread a new requirement to come into the office more. But change at work provides a natural opening to ask for things you might want or need, explained Dan Herron, a financial adviser at Elemental Wealth Advisors in San Luis Obispo, California. This might include more flexibility or even more money. “If all your expenses are higher, this could be a chance to ask for a raise to help offset the increase,” he said.

Brace for the worst. Many of us have gotten into work-from-home routines that save time and cash. But Colin Moynahan, a financial adviser for Twenty Fifty Capital in Charleston, South Carolina, said RTO could change these patterns. “Families should plan for the worst and overestimate what their new expenses will be while not forgetting to look as far down the road as possible for seasonal expenses such as additional childcare during school breaks or at-home childcare if their child’s current provider needs to close temporarily due to a Covid outbreak,” he said.

Reexamine your benefits. Many corporate perks were geared around our old pre-pandemic lifestyles — think pre-tax commuting benefits or gym discounts. Now may be the time to refresh yourself on those policies. Marguerita Cheng, a financial adviser who runs Blue Ocean Global Wealth in Gaithersburg, Maryland, said parents with young children or older, dependent relatives might want to look into their flexible spending accounts. The US is approaching open-enrollment season and making use of such accounts might help offset some of the expenses of caring for a dependent, she said. — Charlie Wells

WealthScore

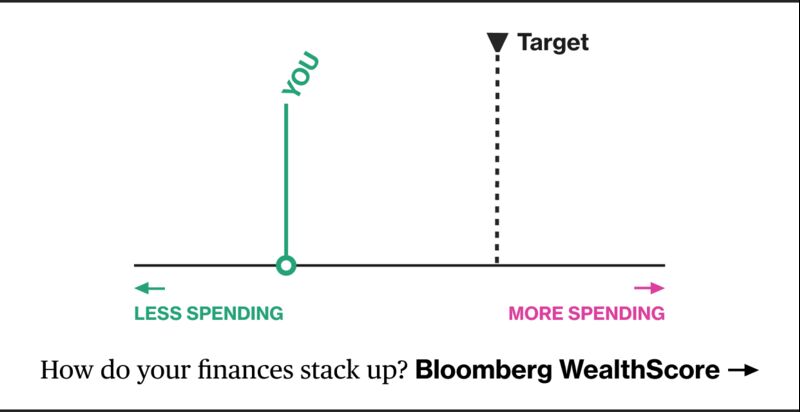

For those trying to gauge where they stand financially, don’t forget we recently launched WealthScore, a tool that allows users to get a financial health checkup by answering questions about their age, household size, income, spending, debt and assets. For the next few weeks, we’ll be sharing tips that correspond with the seven personal finance benchmarks measured by the tool. Here’s our first, relevant for those reevaluating their RTO spending:

Balance your budget. Most of us don’t actually know how much we spend each year as a percentage of our take-home pay. The level of spending experts consider risky is when we spend more than 85% of our take-home pay, leaving us with just 15% for emergencies or to use toward building more financial security. Even a third of Americans making at least $250,000 a year said that they lived paycheck to paycheck in a recent survey.

Many free budgeting apps suggest ways to get a better grip on spending. A popular one is Mint, which syncs with your credit cards, banks and other accounts and categorizes your spending (though you may need to tinker with the categories). If you want to be more hard core and account for where every dollar of your income is going, there’s YNAB (You Need a Budget), which is about $12 a month or $84 a year. — Suzanne Woolley

Don’t Miss

- Amazon has abandoned dozens of existing and planned US facilities.

- Russia privately warned of deep and prolonged economic damage.

- The UK fell behind India to become the world’s sixth biggest economy.

- Bank of America warned of a “recession shock” in stocks.

- Bed Bath & Beyond’s CFO died in a fall from a New York City building.

- Energy rationing in Europe this winter is starting to look inevitable.

- Pain from the strong US dollar is rippling across the world.

Opinion

In Bloomberg Opinion this week, Javier Blas says hoarding toilet paper may have been a smart decision after all:

Who would have thought? It turns out hoarding toilet paper in the early days of the pandemic was a wise financial decision. If your bathroom cupboard is still stockpiled with rolls, you don’t have to feel ashamed anymore.

The toilet paper shortage of 2020 was an early warning sign of the large supply-chain disruptions that the global economy was about to suffer. Now wholesale tissue paper prices are surging to an all-time high — a new crisis that indicates inflationary pressures are still building up.

Read his full article here.

Financial FAQ

What advice would you give to someone who is considering quitting their job now?

Quitting a job is no small decision. You might be able to quit a job but you can’t quit paying bills, so it is important to make sure you have some basic guardrails in place as you ponder exiting the workforce.

Be reasonable. Speak to family, friends, and mentors about your decision to leave the workforce. Rarely can people just exit the workforce indefinitely (except for retirement), so seeking advice before jumping ship can be very helpful.

Mind current expenses. Increase your savings before you quit. A cash savings of nine to 12 months of monthly expenses might be warranted, especially since this account will likely be used to cover current expenses.

Consider future impact. Time is a saver’s strongest ally. It is advisable to check how an exit from the workforce will affect “future you” due to any disruption this might bring to your retirement or other long-term financial goals. — Elliot Pepper, financial planner and director of tax, Northbrook Financial