As 2021 draws to a close, now is a good time to consider smart money moves. “It’s a marathon, not a sprint” may be an overused phrase, but behind every overused cliche there is some element of truth. The majority of financial outcomes are a function of consistent actions and behaviors as opposed to stellar stock picking. While luck, unknown events and variables certainly play a huge role in our lives, small, repetitive, and deliberate actions have an outsized effect on finances. This goes both ways: a series of strong financial decisions compound into a much larger positive result, while a series of poor financial decisions will compound to a much poorer result.

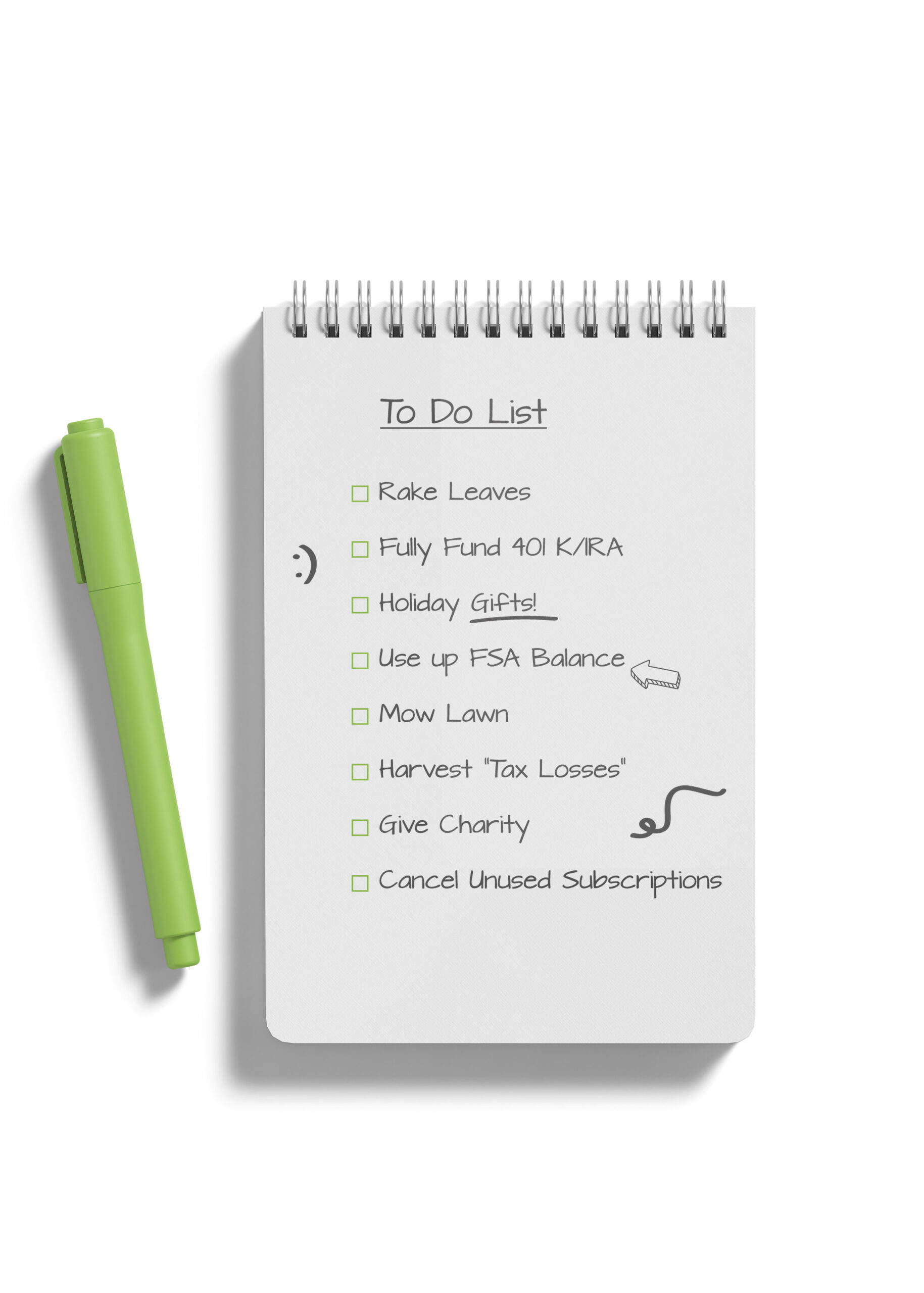

There is nothing like a good old checklist to provide an action plan for this last month of the year, so you can end 2021 strong and be well positioned to an even stronger 2022! Let’s consider the following categories and actionable steps to implement before the end of the year:

Cash Flow Review

- Spending Audit: Between email overload and automated payments, it’s easy to lose track of subscriptions that you do not use anymore. Take a look at your past year’s credit card and bank statements and “audit” the outflows. By doing so, you have just given yourself a raise equal to the subscription fee. You won’t even miss said subscription, since you aren’t even using it! P.S. – Using an online app such as Mint.com can make this very easy.

- Emergency Fund Checkup: Make sure your emergency fund is full. It should have between 3 – 6 months’ worth of expenses.You may find that you have had to draw on that balance during the year, or your monthly expenses may have simply increased.

- Deploy Excess Cash: If you find yourself with additional cash (due to your awesome cash flow management during the year!), consider allocating to accounts that can be invested for growth and provide tax benefits. If you have the ability to add more to HSAs, 401k/403b, IRA, ROTH-IRAs – do it. Your future self appreciates it!

Investment Review:

- Harvest Losses: Do you have unrealized investment losses in your taxable accounts? If so, consider realizing losses to offset any gains and/or write off $3,000 against ordinary income. Be careful not to trigger the dreaded IRS “Wash Sale” rules. Speak to your tax advisor or financial planner about ways to harvest losses without triggering “Wash Sale” treatment.

- Rebalance: Investments go up and investments go down, but rarely do all of your investments go up and down in perfect sync with each other. What typically happens is your target split between stocks and bonds will drift over time, and you will need to rebalance your portfolio by selling some assets and purchasing others. In addition to keeping your investments and goals on the same page, rebalancing is a great way to make sure you are “selling high and buying low.”

Tax Planning:

- Expect your income to increase in the future? If so, consider the following strategies to minimize your future tax liability: Make Roth IRA and Roth 401(k) contributions and Roth conversions. If offered by your employer plan, consider making after-tax 401(k) contributions. If you are age 59.5 or over, consider accelerating traditional IRA withdrawals to fill up lower tax brackets.

- Expect your income to decrease in the future? If so, consider strategies to minimize your current tax liability, such as traditional IRA and 401(k) contributions instead of contributions to Roth accounts.

- Tax Bracket Management: Consider the following important tax thresholds: If taxable income is below $164,925 ($329,850 if MFJ), you are in the 24% percent marginal tax bracket. Taxable income above this bracket will be taxed at 32%. If taxable income is above $445,850 ($501,600 if MFJ), any long-term capital gains will be taxed at the higher 20% rate. If you are on Medicare, consider the impact of IRMAA surcharges based on MAGI.

- Child Tax Credit & Advanced Payments: There are concerns about the upcoming tax year – especially navigating the complexities of advance payments that were made by the IRS. Basically, the IRS made advance payments for 2021’s tax year based on information from 2020 tax forms. These are not stimulus payments, they are simply an advance of the credit you will otherwise claim when filing taxes this year. If you are worried about what this might mean for your taxes in 2021, reach out to your CPA ASAP! Better to be prepared than caught off guard.

- Charity: For taxpayers who claim the standard deduction, you are allowed a deduction of $300 ($600 if MFJ) for cash contributions to certain qualifying charities in 2021. Explore tax-efficient funding strategies, such as gifting appreciated securities. If you expect to take the standard deduction ($12,550 if single, $25,100 if MFJ), consider bunching your contributions (or contributing to a donor-advised fund) every few years which may allow itemization in specific years.

Insurance:

- FSA: Don’t lose it!: Will you have a balance in your FSA before the end of the year? If so, consider the following options your employer may offer: Some companies allow up to $550 of unused FSA funds to be rolled over into the following year. Others offer a grace period up until March 15th to spend the unused FSA funds. Many companies offer you 90 days to submit receipts from the previous year. If you have a Dependent Care FSA, check the deadlines for unused funds as well.

- Health Insurance Deductible: Did you meet your health insurance plan’s annual deductible? If so, consider incurring any additional medical expenses before the end of the year, after which point your annual deductible will reset.

Estate Planning Issues:

- Changes: Have there been any changes to your family, heirs, or have you bought/sold any assets this year? If so, consider reviewing your estate plan.

- Gifts: Are there any gifts that still need to be made this year? If so, gifts up to the annual exclusion amount of $15,000 (per year, per donee) are gift tax-free.

- Beneficiary Designation: Go through all of your accounts (like banks and investments) and insurance policies to make sure that the listed beneficiaries are correct. Family changes or new accounts often result in incorrect beneficiary designations.

Here’s to a strong finish to your 2021 and great start to 2022!